Medigap Persistency

New study of independent Medicare insurance agents finds that more than half of Medigap plans remain on the books for 9 or more years.

The following data is based on a study conducted September 7, 2022 by the American Association for Medicare Supplement Insurance. Data may be used with credit to the Association. We greatly appreciate links to this webpage. https://medicaresupp.org/medigap-persistency/

Participating agents are listed on the Association’s national directory of local Medicare agents. Only agents who have been selling Medigap plans for 5 or more years were included. Data based on 225 replies.

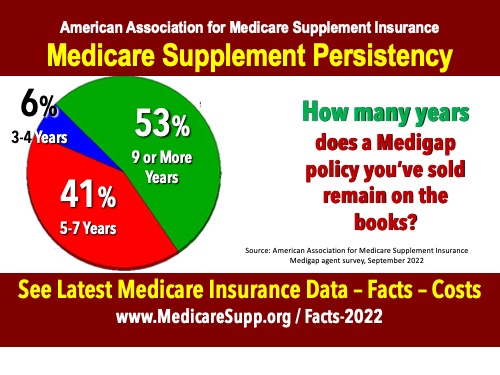

Medigap Persistency: How Many Years ?

The majority (53%) of agents report that the Medigap policies they have sold remain on the books for 9 or more years.

Some 41% note that policies remain active (unchanged) for between 5 and 7 years.

Only 6% reported policies remain on the books for between 3 and 4 years.

Keep in mind that this is anecdotal information. It also reflects just a moment in time.

However, it clearly shows that most people are satisfied with the Medigap plan choice.

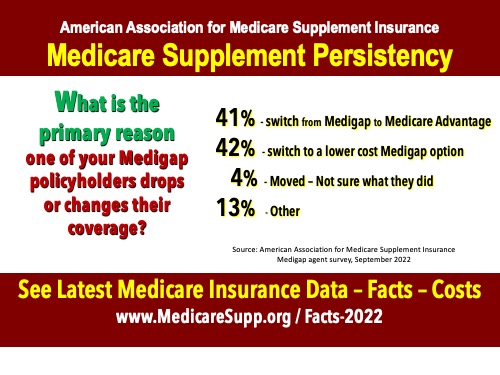

Reasons Policyholders Drop or Change Coverage

Switching to a lower cost Medigap plan option is the reason given for 42% of those agents report decided to switch coverage.

Dropping Medigap for Medicare Advantage was closely behind with 41%.

That could mean switching from one insurer to another (as a result of increasing premiums).

Or, it could be selecting a lower-cost plan (such as a high deductible plan option).

Looking for a ‘Medicare agent near me‘? Access the Association’s online directory. It’s 100% free & 100% private. Simply enter your Zip Code to see Medicare brokers in your area.

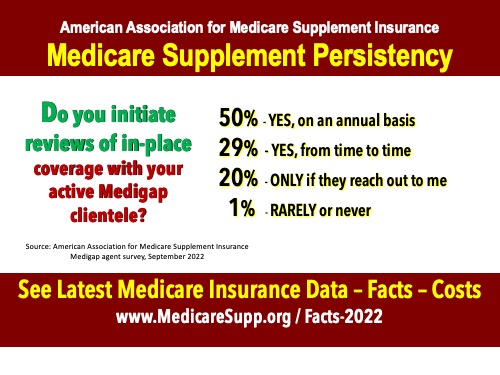

Medigap Persistency: Agent Reviews

Half of the agents shared they reviewed Medigap policy options with current clients on an annual basis.

Several commented they did this because competition made higher levels of customer service vital.

Only 1% noted they rarely or never initiated a review with current clients.

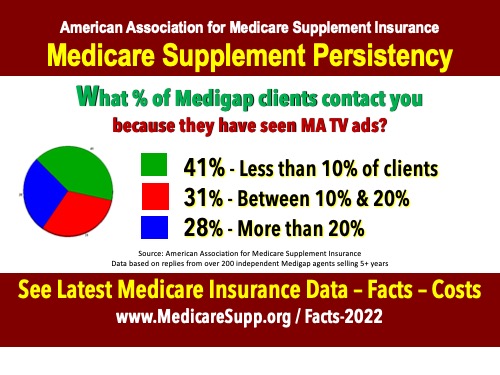

Impact of Those Joe Namath Ads

The television airwaves are crammed with ads primarily promoting Medicare Advantage options.

Joe Namath is the most prominent spokesman being used.

Surveyed agents noted that clients are contacting them directly as a result of seeing MA TV ads offering no-premium coverage or included ancillary benefits. These include dental and vision coverage.

AGENTS: Be listed on the Association’s national directory when consumers search for a ‘Medicare agent near me‘. Click to read testimonials from listed Medicare agents.

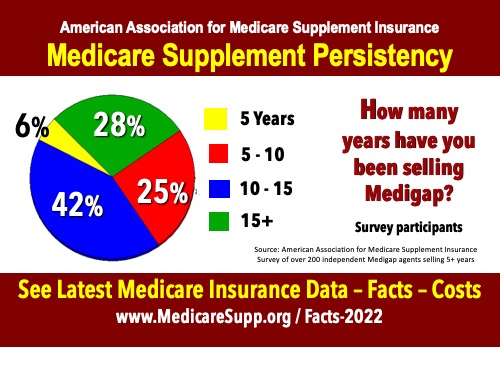

Survey Participants Are Seasoned Medigap Insurance Agents

The majority of survey participants have been selling Medigap plans for 10 or more years.

The majority of survey participants have been selling Medigap plans for 10 or more years.

This is important because of the nature of the questions (how long do Medigap plans stay on the books).

We thank the many agents who took time to participate.

For more Medicare insurance data and statistics, visit other pages on the Association’s website.